The Influence of Foreign Investors on the Japanese Stock Market

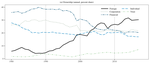

We investigate the information content of foreign investors’ stock market trades. We analyse a 39 year sample using a consistent set of transactions and returns data. Foreign investors' trades influence the efficient price of Japanese stocks. Their trades have increasingly reflected global stock prices and the exchange rate. Global stock price information since the 2000s and exchange rate since the 2010s.

Keywords: Efficiency; Equities; Foreign investors; Information content of trade; Investor behaviour; Market microstructure

JEL classification: C32; G14; G15