Does Firm-Level Productivity Predict Stock Returns?

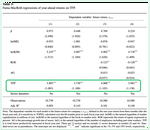

Contrary to the findings of previous U.S. studies, we show that the firm-level total factor productivity (TFP) of Japanese manufacturers positively predicts their future stock returns in the cross-section when controlling for relevant risk factors, including those of Fama and French (2015). Risks related to intangible expenditure, primarily those for research and development (R&D) and personnel, explain a substantial fraction of the predictive power of firm-level TFP, while bankruptcy, macroeconomic, and capital expenditure risks do not. More productive firms trade at a significant premium to less productive firms. This premium compensates investors for risks associated with innovation and human and organizational capital formation.

Keywords: Firm-level productivity; Total factor productivity (TFP); Cross-section of returns; Intangibles; Research and development (R&D); Organizational capital

JEL classification: D24; G12; G14; G17