The changing role of foreign investors in Tokyo stock price formation

Abstract: Recent research suggests that foreign investors improve the informational efficiency of national stock markets. We examine how foreign investors contribute to efficiency. We model the influence of domestic and foreign investors’ trades on the efficient price of Japanese stocks over 39 years. Our results show that foreign investors trade at an information advantage over domestic investors, and this advantage has increased since around 2000. We find this is due to a substantial increase in the importance of global stock price and exchange rate information in stock price formation. Our results suggest that foreign investors have made more use of global information in trading Japanese equities as the influence of international financial factors on the domestic market has increased over recent decades.

Keywords: Efficiency, Equities, Foreign investors, Information content of trade, Investor behaviour, Market microstructure

Summary:

We investigate the information content of foreign investors’ stock trades.

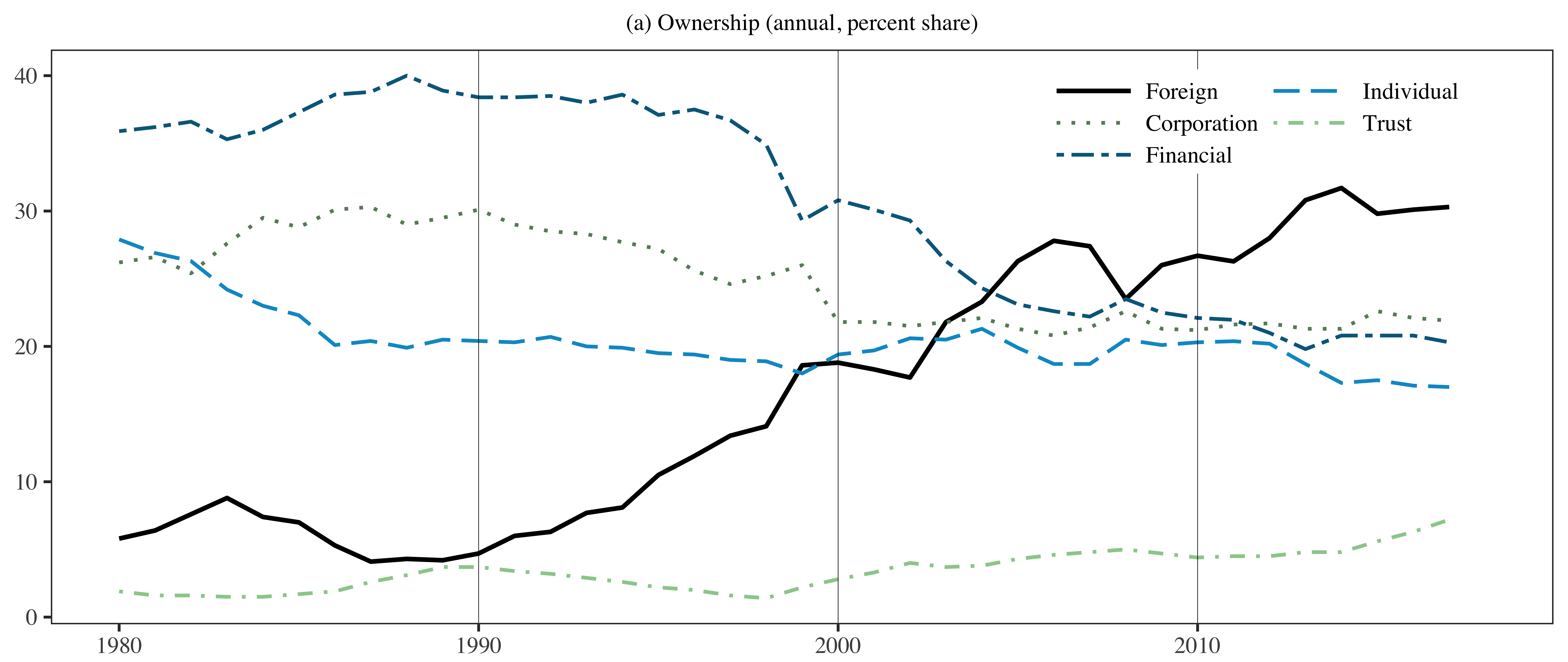

We analyse 39 years of consistent transactions and returns data.

Foreign investors trade at an information advantage to domestic investors.

Their trades have increasingly reflected global stock prices and the exchange rate.

Global stock price information since the 2000s and exchange rate since the 2010s.