Causality between Arbitrage and Liquidity in Platinum Futures

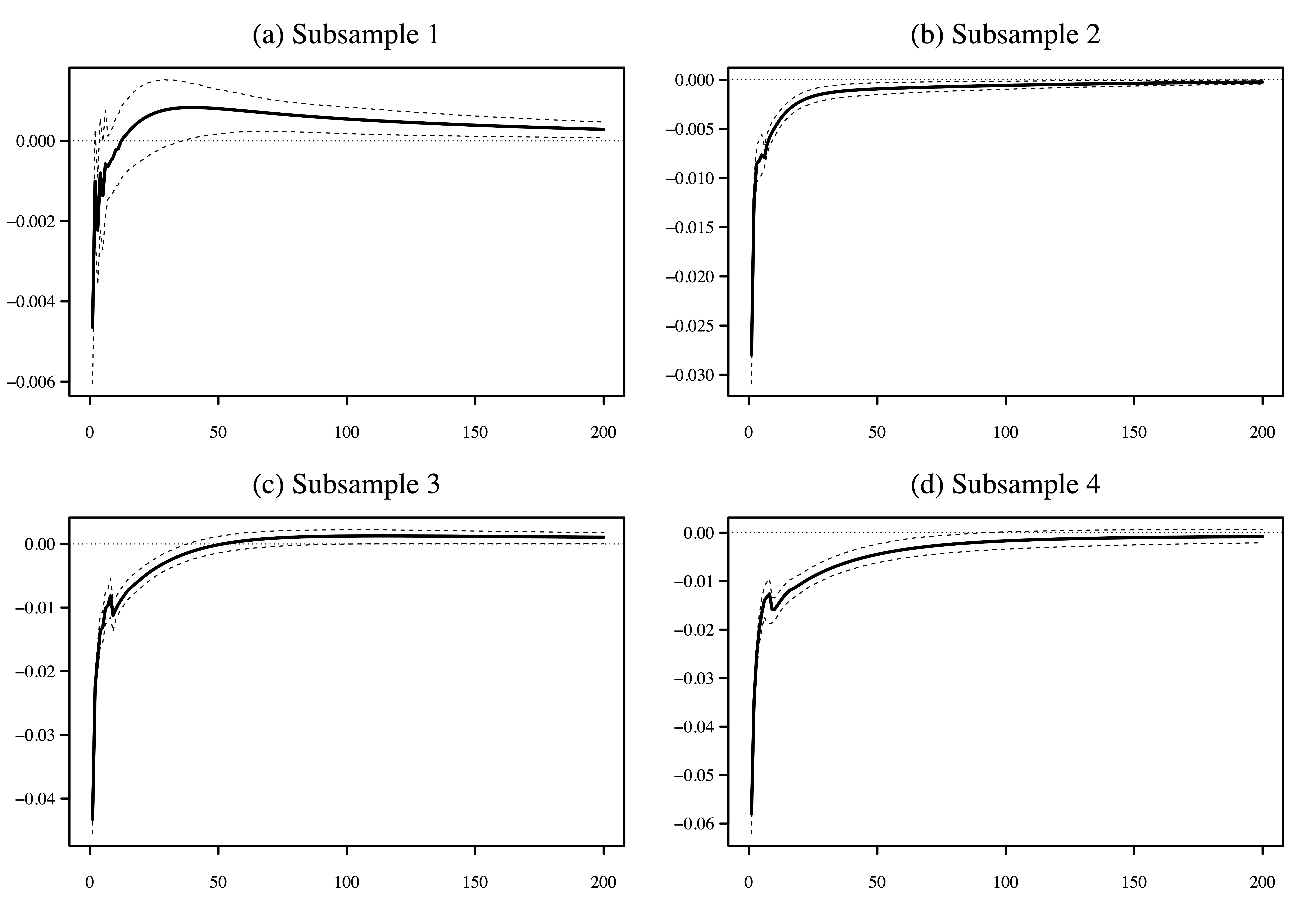

Abstract: Arbitrage and liquidity are interrelated. Liquidity facilitates arbitrageurs’ trading on deviations from the law of one price. However, whether arbitrage opportunity leads to an increase or decrease in liquidity depends on the cause of the deviation. A demand shock leads to greater liquidity, while asymmetric information is toxic to liquidity. We examine how arbitrage and liquidity influence each other in the world’s largest platinum futures markets on exchanges in New York and Tokyo. The markets provide an interesting institutional setting because the futures are based on an identical underlying commodity but exhibit different liquidity characteristics both intraday and over their lifespans. Using intraday data, we find that deviation in currency-adjusted futures prices leads, on average, to an immediate increase in liquidity, suggesting that demand shocks are the dominant driver of arbitrage opportunities. Less actively traded futures experience a greater liquidity effect. Arbitrageurs improve liquidity in both New York and Tokyo by acting as discretionary liquidity traders and cross-sectional market-makers.

Keywords: Arbitrage, Commodities, Efficiency, Futures, Liquidity, Market integration, Market microstructure, Platinum

Summary:

Using intraday data, we find that deviation in currency-adjusted futures prices leads, on average, to an immediate increase in liquidity, suggesting that demand shocks are the dominant driver of arbitrage opportunities.

Less actively traded futures experience a greater liquidity effect.

Arbitrageurs improve liquidity in both New York and Tokyo by acting as discretionary liquidity traders and cross-sectional market-makers.