Does firm-level productivity predict stock returns?

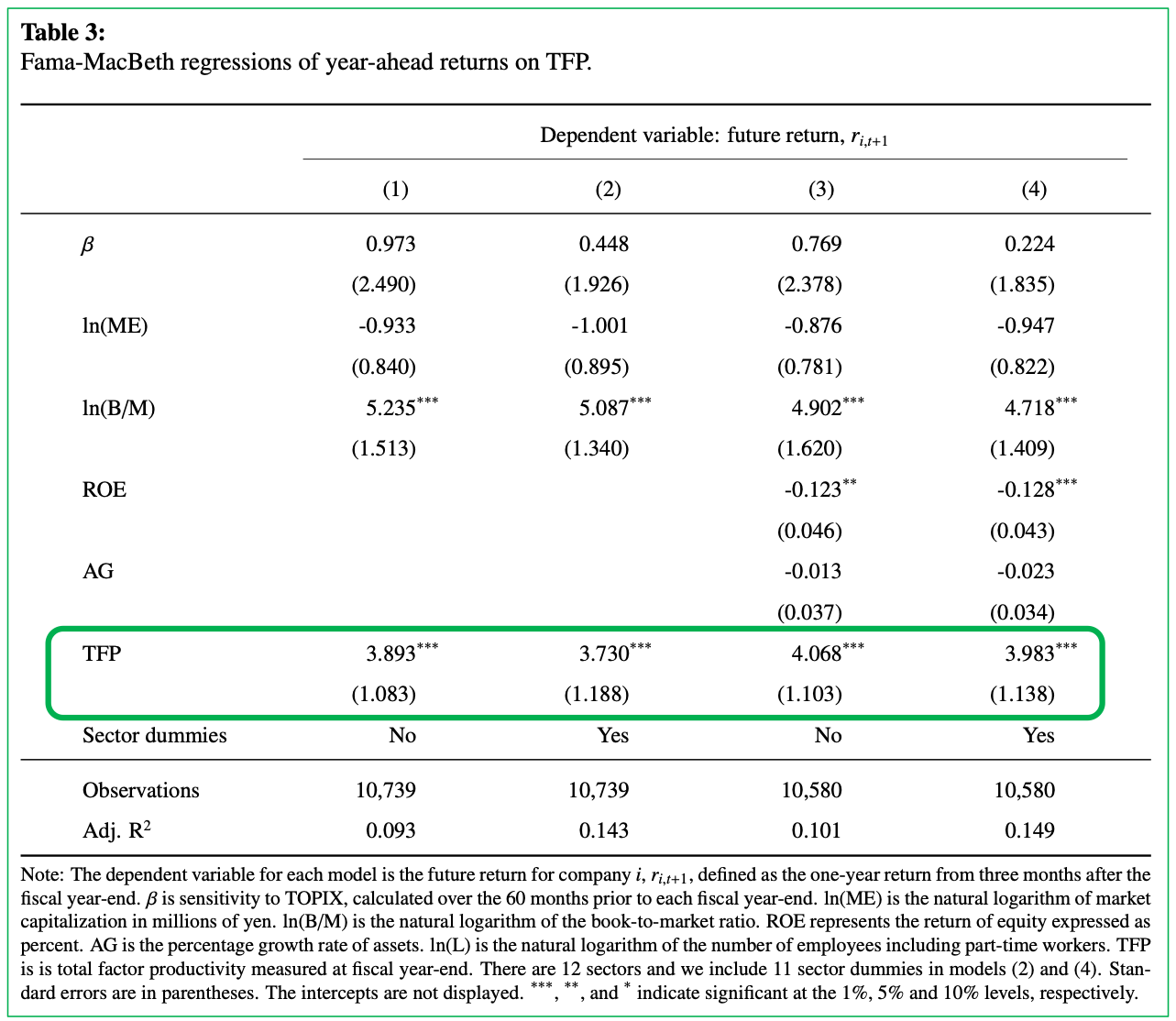

Abstract: Contrary to the findings of previous U.S. studies, we show that the firm-level total factor productivity (TFP) of Japanese manufacturers positively predicts their future stock returns in the cross-section when controlling for relevant risk factors, including those of Fama and French (2015). Risks related to intangible expenditure, primarily those for research and development (R&D) and personnel, explain a substantial fraction of the predictive power of firm-level TFP, while bankruptcy, macroeconomic, and capital expenditure risks do not. More productive firms trade at a significant premium to less productive firms. This premium compensates investors for risks associated with innovation and human and organizational capital formation.

Keywords: Firm-level productivity, Total factor productivity (TFP), Cross-section of returns, Intangibles, Research and development (R&D), Organizational capital, Japanese stocks

Summary:

We show that firm-level TFP positively predicts future stock returns in Japan.

This result is robust even when controlling for relevant risk factors, including those of Fama and French (2015).

This finding is in contrast to those of previous studies in the U.S.

Risks related to intangible expenditure, primarily those for R&D and personnel, explain a substantial fraction of the predictive power of TFP.

The premium on high TFP stocks compensates investors for risks associated with innovation and human and organizational capital formation.