Behavioural Finance

Overview

Researchers such as Daniel Kahneman (winner of the 2002 Nobel Prize in Economics), Robert Shiller (joint winner of the 2013 Nobel Prize in Economics) and Richard Thaler (winner of the 2017 Nobel Prize in Economics) pioneered the application of concepts from psychology to economic and financial decision-making. In behavioural economics and finance, we use principles from psychology to describe how individuals actually make economic and financial decisions, in contrast to the way rational agent models suggest individuals should make decisions.

Objectives

- distinguish between the approaches and assumptions of conventional and behavioural finance, and discuss the relationship between the two fields.

- explain the behavioural and psychological influences on economic and financial decision-making.

- apply behavioural finance research and psychological concepts to problems in finance.

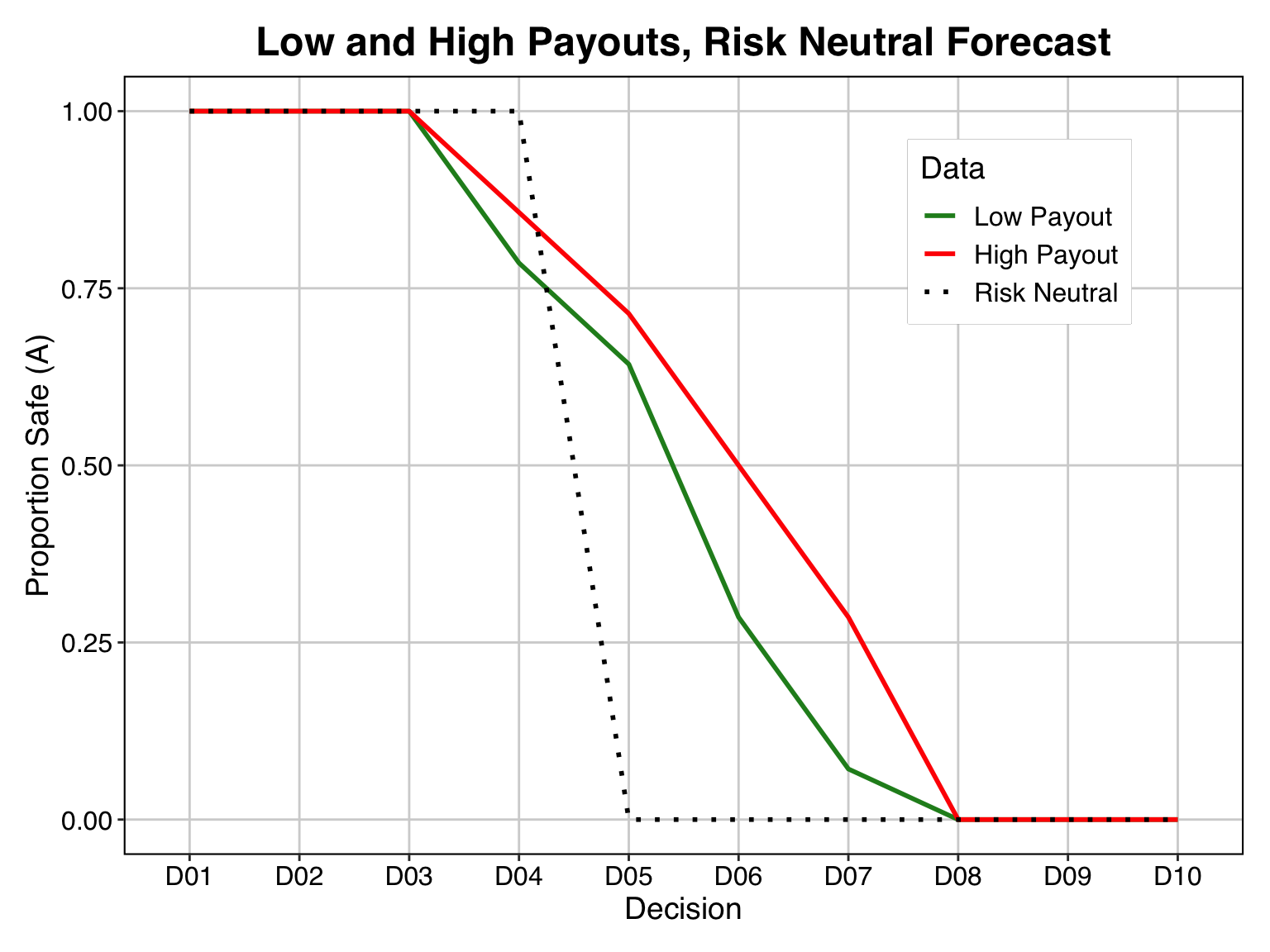

- interpret experimental evidence generated by researchers in behavioural economics & finance.

FAQs

We will do examine how psychological factors influence economic and financial decision-making. We will interpret key research findings and run decision-making experiments during class.

Financial Theories and Applications is recomended but not mandatory.