Economic & Financial Crises

macroeconomics

finance

financial crises

banking

financial system

graduate

We will examine the salient features of crises in both emerging and developed economies and cover Hyman Minsky’s financial instability model. The course touches on economic history, international macroeconomics, international finance, banking, financial markets, regulation, government finances, international relations and politics. Students will develop a deep understanding of economic and financial crises, their causes and consequences.

Course overview

We will examine the salient features of past crises in both emerging and developed economies and cover Hyman Minsky’s financial instability model in detail. The course will include aspects of economic history, international macroeconomics, international finance, banking and financial markets, regulation, government finances, international relations and politics. By successfully completing this course, students will develop a deep understanding of economic and financial crises, their causes and consequences.

Course objectives

By the end of the course, students should be able to identify and and knowledgeably discuss:

- the warning signs ahead of a crisis.

- the nature of asset price bubbles.

- the stages of a typical crisis and the different types of crises.

- economic theories of crises, including Minsky’s Financial Instability Hypothesis.

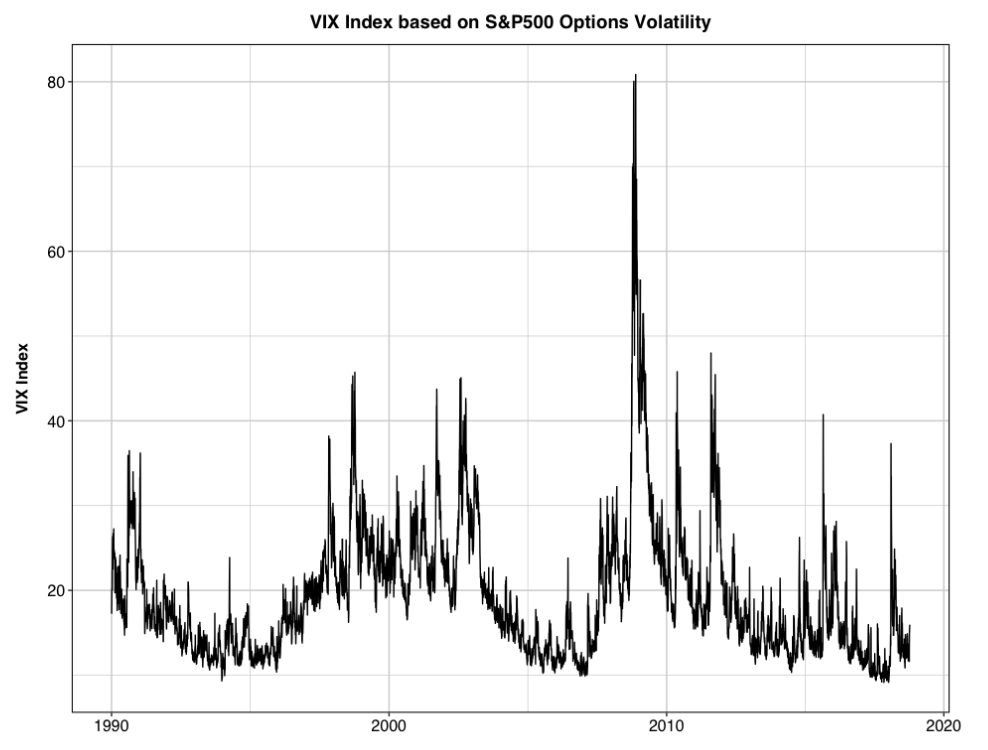

- implications of crises for the macroeconomy and financial markets.

- pros and cons of policy measures used to deal with a crises.

- the history and lessons of various financial crises.