Portfolio Management (Investment)

Download the Syllabus An Introduction to R and RStudio

What you will learn

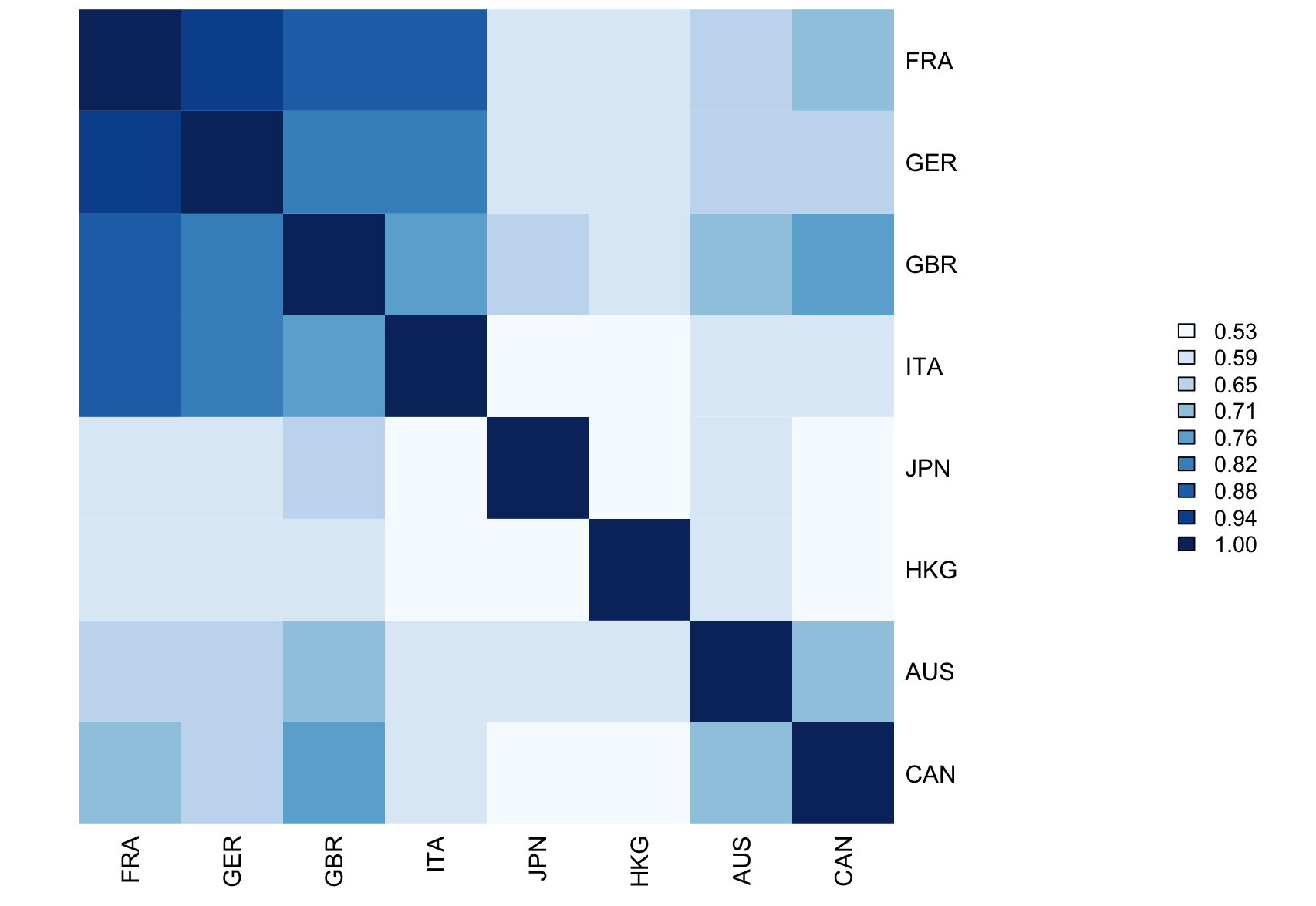

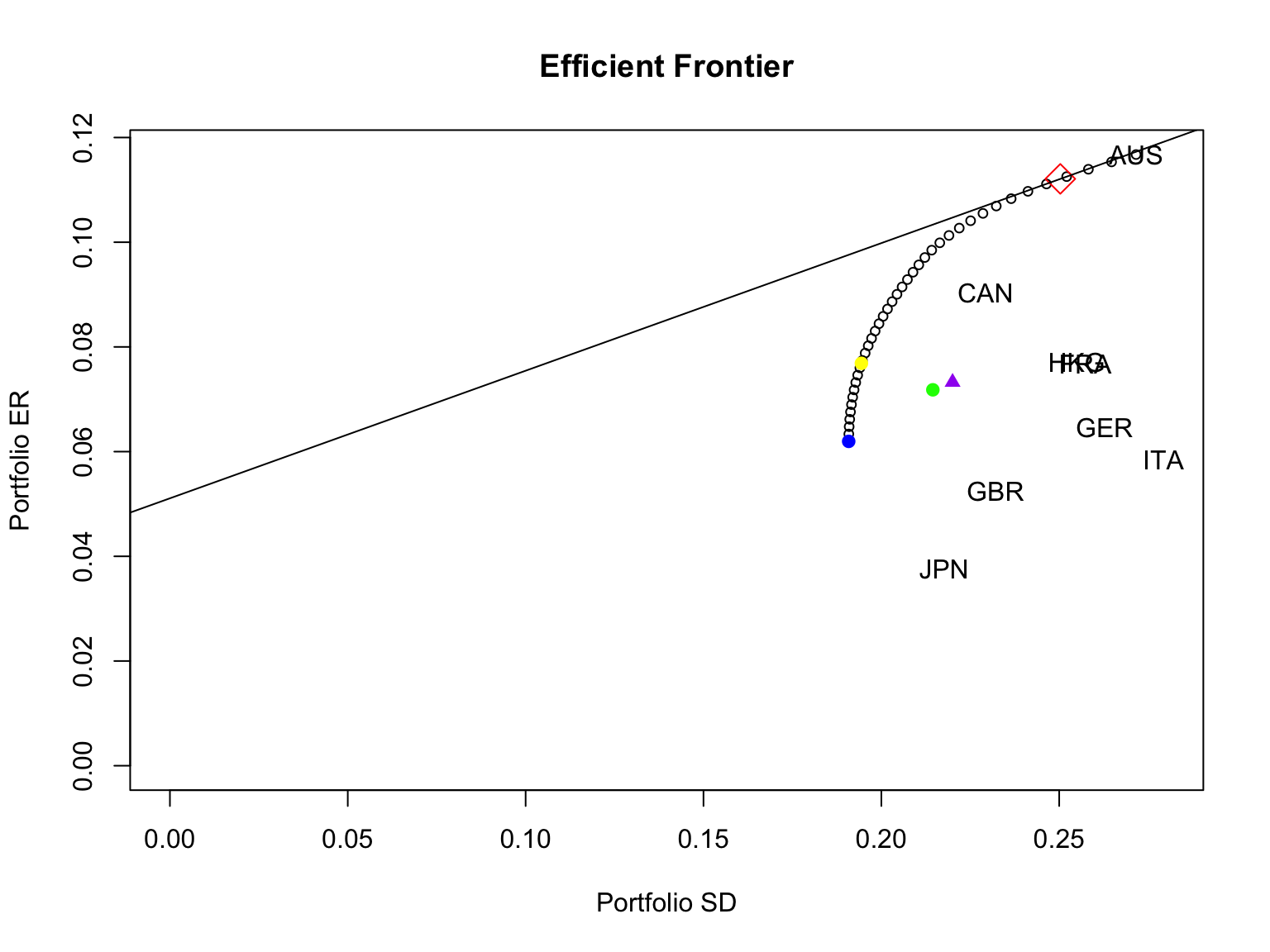

This course is about the theory and practice of investment management. The course covers investment theory and concepts including security valuation, Modern Portfolio Theory, the risk/return trade-off, diversification, and the Black-Litterman Model. We will use these theories to construct portfolios using securities data in excel and R, and create portfolio analytics using R. We will discuss practical aspects of investment management, as well as the current situation of the investment management business in Japan and overseas. We also cover practical aspects of investment management such as investment philosophy, portfolio design, risk management, performance evaluation, ethics and fiduciary duty.

Objectives

By the end of this course, students should have a clear understanding of how financial assets are combined into portfolios, and the issues involved in real world portfolio management. Students should be competent in understanding, analysing and constructing investment portfolios comprised of stocks, bonds and alternative assets.

FAQs

Mathematics, Statistics and Financial Theories and Applications